When asked what the hottest opportunities in Chicago are the first thing I want to know is what is your motivation? Are you looking for a place to live or somewhere to invest? If you are looking for a place to live then we need to discuss your lifestyle habits, wants, and needs. If you are looking for a place to invest then we need to discuss your investment goals. Are you looking for an up and coming neighborhood? How long do you plan to hold the investment? Do you want a neighborhood with a lot of growth potential or do you want something that is well-established, but may still yield a nice return when you go to sell.

If you do a search for the hottest neighborhoods in Chicago you will find lists assuming you are looking for a place for yourself to live. A lot of the old favorites show up, these are neighborhoods that have been under heavy development for decades. Some are well established and some are rather newly established, by which I mean you will find locals who claim to be pioneers of the neighborhood. Always hot neighborhoods such as these include; Hyde Park, Irving Park, Lakeview, Lincoln Park, Logan Square and Bucktown, Roscoe Village (North Center), Pilsen (Lower West Side), West Loop (Near West Side), The Loop, Streeterville, River North, Gold Coast, Old Town (all four in the Near North Side), Andersonville (Edgewater), West Town and Wicker Park, Printer’s Row, South Loop (both in the Near South Side), and Bridgeport. That’s not even an extensive list.

Looking at the 2021 Annual report we can see nice growth in all of these neighborhoods. The change from 2020 in total closed sales ranged from 14.3% in Irving Park to 95.6% in the Loop! With a median showings per listing ranging from 4-6 among all of these neighborhoods. With a high range of closed sales for YOY and very few showings it is clear these neighborhoods were high in demand for 2021. Next, let’s see how they are doing now YOY.

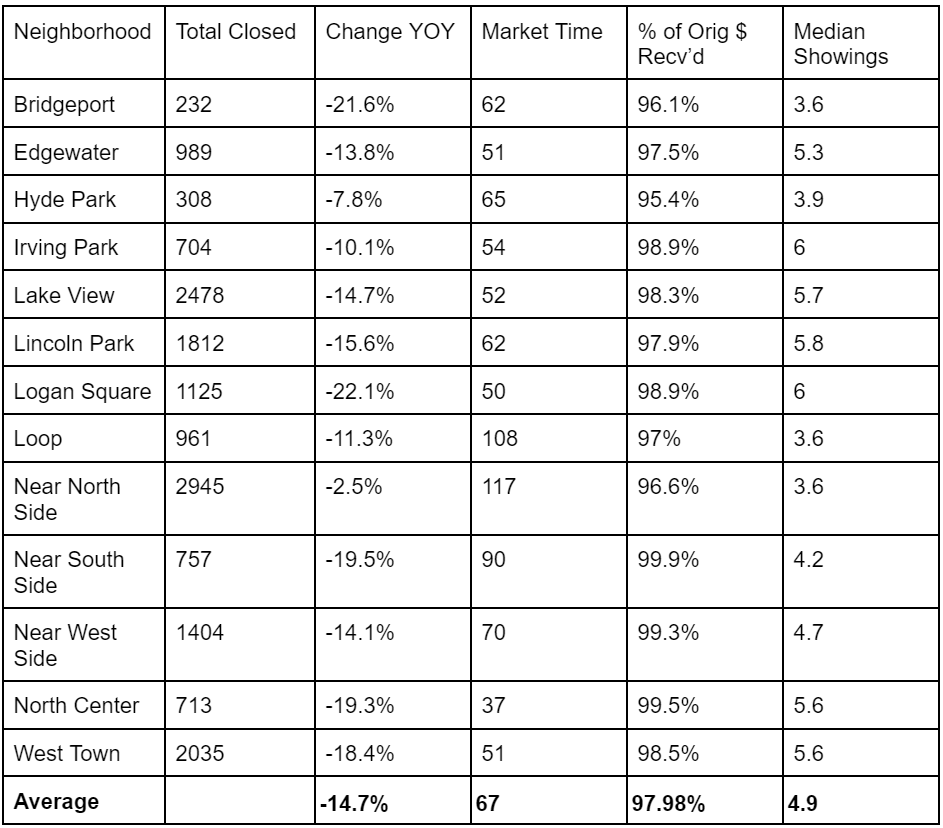

Interestingly, over the past year all of these neighborhoods have seen a drop in units sold. I actually ran these numbers about two months ago and in updating them for today I found the number of units sold dropped even more from an average change YOY of -8.98% to -14.68%. Even though the number of properties selling has been dropping, overall, these areas are still looking desirable with low market times of under 3 months and a high percentage received of original asking price, 95% or more. These are neighborhoods I would suggest one consider if they are looking for a stable investment. They are well-developed with sustained interest. In these locations we can find properties that will rent easily, but won’t change dramatically in value from year to year.

The 2022 Annual Report should be available before my next blog post. From it we can use the same data to find neighborhoods that are steadily growing and find out what other investment opportunities there might be for different strategies.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link