How Long Does Foreclosure Take in Illinois? Key Milestones and What to Expect

Introduction:

If you’ve fallen behind on mortgage payments, you might be wondering how much time you have before foreclosure is final. Understanding the foreclosure process can help you make informed decisions and explore possible solutions before it’s too late.

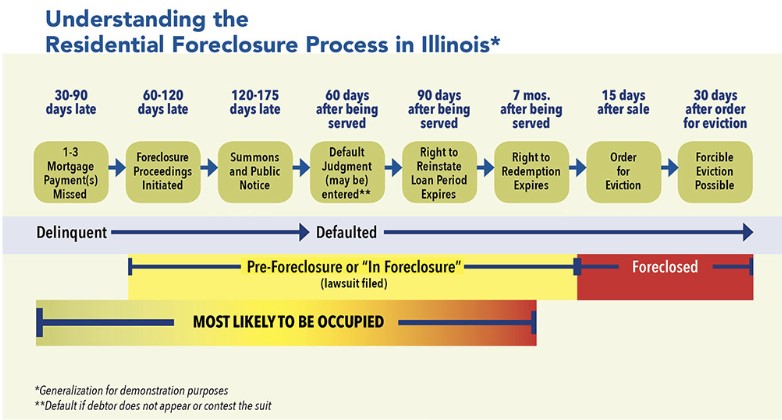

Illinois is a judicial foreclosure state, which means lenders must go through the court system to complete a foreclosure. This typically makes the process longer than in non-judicial states, giving property owners more time to take action.

Here’s a general breakdown of the foreclosure timeline in Illinois and what you can do at each stage.

Step 1: Missed Mortgage Payments (Day 1-90)

What Happens?

- Most lenders allow a 15-day grace period before considering a payment late.

- After 30 days, the loan is officially delinquent, and late fees may be added.

- At 60-90 days, lenders typically send a Notice of Default (NOD) or warning letter.

What You Can Do:

- Reach out to your lender—Many offer temporary forbearance or repayment plans.

- Speak with a HUD-approved housing counselor to explore assistance programs.

- Review your options for loan modification, refinancing, or other alternatives.

Step 2: Pre-Foreclosure & Demand Letter (Around Day 90-120)

What Happens?

- After 90+ days of missed payments, the lender may send a Demand Letter requiring payment by a specific deadline.

- If payment is not made, the lender may file a foreclosure lawsuit in court.

What You Can Do:

- Negotiate with your lender to explore a repayment plan or loan modification.

- Seek legal advice if you want to contest the foreclosure.

- Consider selling your property—Some owners opt for a quick sale to avoid foreclosure.

Step 3: Foreclosure Lawsuit & Court Process (Day 120+)

What Happens?

- The lender files a foreclosure lawsuit, and you’ll receive a Summons & Complaint.

- You have 30 days to respond in court.

- If you don’t respond, the lender may request a default judgment, moving the process forward.

- If you respond, the case goes through the legal process, which could take months to over a year.

What You Can Do:

- File a response in court—If you believe there’s a legal defense, a foreclosure attorney can advise you.

- Explore mediation—Some Illinois courts offer foreclosure mediation programs.

- Continue seeking alternatives—Even at this stage, options like selling or working out a settlement may still be possible.

Step 4: Judgment & Redemption Period (6-12+ Months In)

What Happens?

- If the court rules in favor of the lender, a Judgment of Foreclosure is issued.

- Illinois law provides a redemption period, typically 90 days to 6 months, where you can pay off the loan and stop the foreclosure.

- If no resolution is reached, a sale date is set for the property.

What You Can Do:

- Use the redemption period to catch up on payments if financially possible.

- Seek assistance programs that may help with funds or refinancing.

- Consider a short sale or deed in lieu of foreclosure to minimize credit damage.

Step 5: Foreclosure Sale & Eviction (Typically 12+ Months In)

What Happens?

- The lender holds a foreclosure auction, and the property is sold to the highest bidder.

- If the property doesn’t sell, the lender may take ownership (REO property).

- After the sale, the owner may receive an eviction notice, typically allowing 30-60 days to vacate.

What You Can Do:

- If foreclosure is complete, focus on planning your next steps, such as finding rental housing or rebuilding credit.

- Seek legal guidance—In some cases, eviction defenses or additional time extensions may be possible.

Understand deficiency judgments—If your property sells for less than you owe, Illinois allows lenders to pursue the remaining balance unless settled in court.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link