Foreclosure Doesn’t Happen Overnight – Here’s What You Need to Know

Introduction:

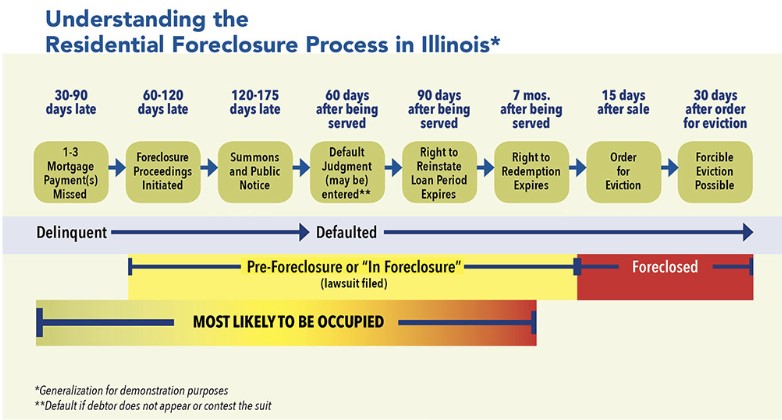

If you’re behind on your mortgage, understanding the foreclosure timeline is critical. Many property owners feel overwhelmed, unsure of how much time they have or when they need to act. The truth is, the earlier you take action, the more options you have to avoid foreclosure and protect your future.

In this post, I’ll walk you through a typical foreclosure timeline, what to expect at each stage, and the key moments when you still have options to stop the process.

Stage 1: Missed Payments (1-3 Months Late)

Foreclosure doesn’t begin the moment you miss a payment, but after 30 days, your lender will report the missed payment to the credit bureaus, impacting your credit score.

What Happens:

- You may receive a late payment notice and a late fee.

- Your lender will start contacting you about your missed payment.

- You still have the opportunity to make up the payment without serious consequences.

What You Can Do: If you’re struggling financially, contact your lender immediately. Some offer loan modifications, forbearance, or repayment plans to help you catch up.

Stage 2: Notice of Default (3-6 Months Late)

Once you’re 90 days behind, most lenders will issue a Notice of Default (NOD) or a similar legal notice, depending on your state. This is the first official step in the foreclosure process.

What Happens:

- The lender formally notifies you that you’re in default.

- You may have a grace period (often 30-90 days) to catch up on payments.

- The lender may start working with attorneys to prepare for foreclosure.

What You Can Do: This is a critical time to act. Options include applying for a loan modification, considering a short sale, or exploring refinancing options if your credit still allows it.

Stage 3: Pre-Foreclosure & Public Notice (6+ Months Late)

At this stage, if you haven’t worked out a solution with your lender, they will file a Notice of Trustee’s Sale or Notice of Foreclosure Sale, which becomes public record.

What Happens:

- Your home may be listed in local foreclosure auctions.

- In some states, you may receive a court summons if the foreclosure is judicial.

- You still have time to sell your home or negotiate with your lender.

What You Can Do: Selling your home now—through a traditional sale, short sale, or to an investor—could help you avoid foreclosure while protecting your credit.

Stage 4: Foreclosure Sale (Auction or Bank Repossession)

If no resolution is found, the lender will proceed with a foreclosure sale at auction or take ownership of the property.

What Happens:

- The property is auctioned to the highest bidder, or

- If no buyers step forward, the lender takes ownership, and it becomes a Real Estate Owned (REO) property.

- You may be required to vacate the home after a legal process.

What You Can Do: At this point, your options are limited, but you may still negotiate a cash-for-keys agreement with the lender to help with relocation costs.

When Is the Best Time to Act?

The earlier you take action, the better your chances of avoiding foreclosure. Here’s a quick guide:

0-3 months late: Best time to negotiate with your lender.

3-6 months late: Still time to explore loan modifications or sell your home.

6+ months late: Urgent—limited options remain, but selling quickly may still help.

How I Can Help

I’ve worked with property owners facing foreclosure, helping them explore options like:

✅ Selling their home quickly to avoid foreclosure.

✅ Navigating lender negotiations for loan modifications.

✅ Understanding short sales and other alternatives.

If you’re unsure what to do next, let’s talk.

Conclusion:

Foreclosure doesn’t happen overnight, and you have more time—and options—than you may think. But waiting too long can make it harder to find a solution. If you’re behind on payments, now is the time to explore your choices before foreclosure becomes final.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link